At Limestone Financial Planning, we can provide advice on various structures such as Managed Funds.

When we provide investment advice we ensure:

- We’ve identified your goals, values and circumstances

- Your goals are realistic given your timeframe for investing

- You’re aware of your investing style and tolerance for risk

- You understand how the investment works

- You’re aware of the risks involved and have weighed these up against the potential returns

- We have recommended a mix of investments to help control the total risk of your investment portfolio

- You have control of your debts, enough insurance coverage and money for emergencies

- We identify available tax effective investment vehicles

- We consider fees and the impact of fees on your investment

- Consideration if “borrowing to invest” or gearing may be appropriate for you

- Consideration of your estate planning consequences of your investment – what happens in the event of death?

- Regular reviews to ensure the investments are still appropriate for you, and we adjust them if conditions or your circumstances change

Setting your investment goals

A sound approach to investing starts by identifying what you want to achieve by when. The good thing about setting goals is it forces you to plan. Having a plan, ideally written down, helps motivate you to stick to it. You may want to start with an easy goal such as taking a trip or paying for some extra study. Then, once you’ve achieved that goal, you’ll feel more confident about going after your longer-term goals.

What’s important to you?

Your investment goals will reflect your values – what you feel is important in life. But your values may also affect what you decide to invest in. We can help you identify your investment values and recommend appropriate investments according to those values.

Information to consider when investing:

- Types of Asset classes

The main asset classes that may be invested into directly or via managed funds are generally cash, Australian fixed interest, international fixed interest, Australian shares, international shares, listed property (i.e. listed on the stock exchange) and direct property. - Risk Return Trade off

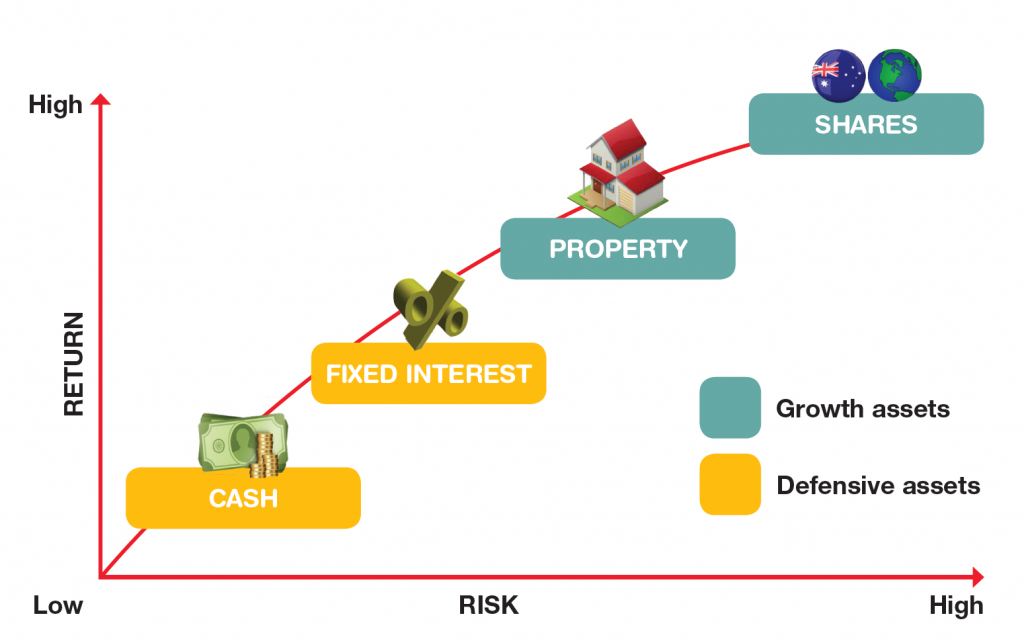

As investors, in general, are risk averse, they will require a higher rate of return before accepting a higher degree of risk; this is referred to as the ‘risk premium’. Accordingly, as potential risk increases, so too does expected return. This relationship is known as the risk/return trade-off, as illustrated in the graph below.

- Investment timeframe

One of the primary issues to consider is the timeframe of investing, i.e. the length of time to hold various classes of assets to obtain the benefit of investing. Investment time frames are generally described as short term (1 – 3 years), medium term (3 – 5 years) and long term (5 – 7+ years). Generally, it is recommended to hold cash and fixed interest type investments over the short term, property over the medium term and shares over the long term, due to the varying degrees of volatility (variability in returns) associated with these investments. - Diversification

Diversification risk is the risk of investing in one or few asset classes, or even a single investment, such as a rental property or direct shares. The performance and eventual repayment of your investment depends on the performance of this single investment. Diversifying your investments means “don’t put all your eggs in the one basket”. We can help you with choosing a diversified mix of assets which is suitable for your investment risk tolerance and preferences.

At Limestone Financial Planning, we can advise you on the most suitable investment strategy, based on your goals, objectives and needs.

Phone us on 07 3812 7122 for an appointment time with an Adviser.

Superannuation |  Accessing your super |  Managed Investments |