No matter how many hours you work, if you are over preservation age, you can access your super as a transition to retirement (TTR) pension, even if you are still working full time. In some ways you get the best of both worlds. A TTR pension could be used to help ease you into retirement or increase your super account without reducing your current income.

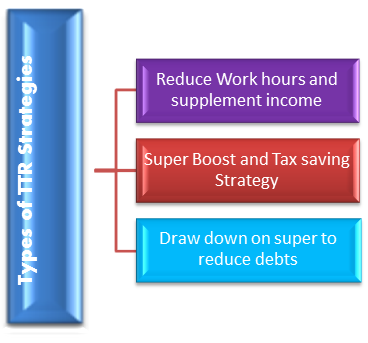

There are 3 main ways to use a ‘Transition To Retirement’ (TTR) pension.

What are Transition to Retirement Strategies?

The transition to retirement (TTR) condition of release was introduced in July 2005 and was designed to allow people who have reached preservation age and are still working to access their superannuation in the form of a non-commutable account based income stream known as a transition to retirement income stream.

Who can benefit from these strategies?

A transition to retirement strategy may be suitable if you:

• are aged over the super preservation age

• want to supplement your income, or

• would like to boost your super savings and pay less tax

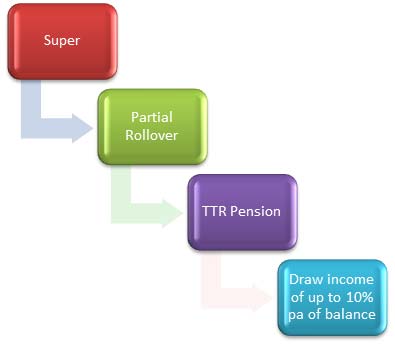

How does it work?

A TTR strategy involves substituting your earned income with an income stream from a TTR pension.

Transition to Retirement Strategies |  Allocated Pensions and Account-based Pensions |  Annuities |